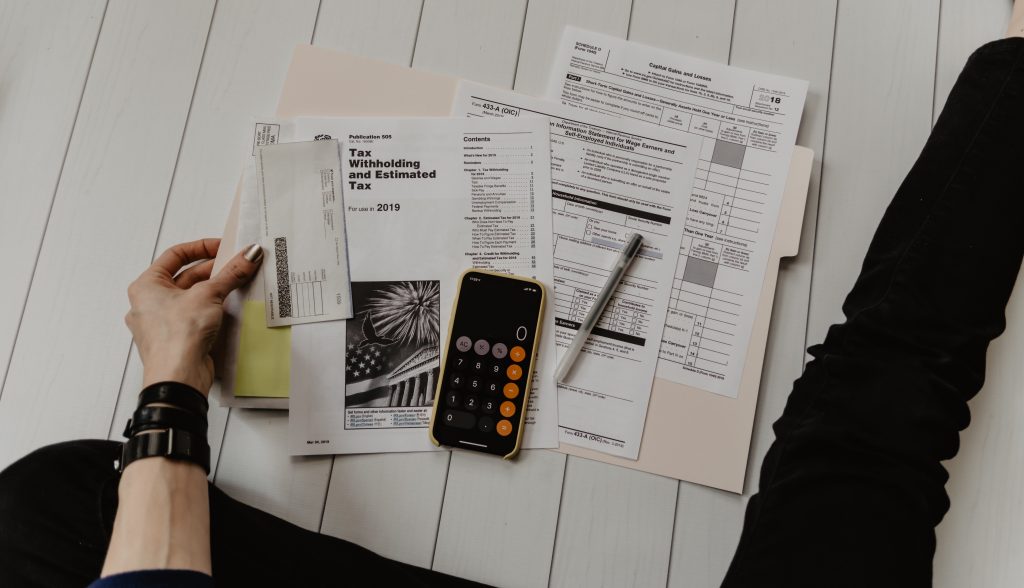

What is the difference between tax avoidance and tax evasion? The simple difference is that avoidance is legal and evasion is illegal. However, aggressive avoidance schemes can be challenged by HMRC and can result in a legal challenge, penalties and a hefty tax bill. It is not always clear cut so it is important toREAD MORE

CUT TAXES TO BOOST LABOUR MARKET, REED CHAIRMAN URGES. The chairman one of the UK’s biggest recruitment agencies has said high taxes are deterring people from returning to the labour market after the exodus of workers during the pandemic. James Reed, the chairman of Reed, said at an event in London: “For a lot ofREAD MORE

Many small and medium sized Companies use a traditional approach to taking salaries and dividends from the company. They look at the profit available and take out what the Company can afford. SALES – EXPENSES = PROFIT They simply look at their sales deduct their expenses and arrive at the profit. But there is aREAD MORE

If you are about to start a business, setting a business plan will help you focus on getting it right. So why write a business plan? Firstly and most likely you will need funding. Investors will want to see that you have the right plan in place to succeed. They rely on business plans toREAD MORE

TAX RATES Below is a resume of applicable tax rates for individuals in the UK. It is not exhaustive but outlines the main components of tax that will impact on many taxpayers over the years. As we have emphasised in the past it is very important to tax plan and to use all the allowancesREAD MORE

Management reporting is essential for businesses to assess their performance, identify areas of improvement, and make informed decisions. Here are some of the key reasons why management reporting is important: Provides insights into business performance: Management reporting provides critical information about how a business is performing. By analysing data, managers can identify trends and patterns,READ MORE

Financial reporting is critical for businesses to provide information about their financial performance to stakeholders, such as investors, lenders, and regulators. Here are some key reasons why financial reporting is important: Provides information for decision-making: Financial reporting provides stakeholders with information about a business’s financial health, allowing them to make informed decisions about investing, lending,READ MORE

To help with tax planning for the 2023/24 tax year we are putting together a list of tax saving tips for businesses and taxpayers. Personal Pension: Personal Pension is a tax-efficient way to save for retirement. Contributions made to a personal pension are tax-deductible, and the investment returns are tax-free until the funds are withdrawn.READ MORE

Making sure you have a good accountant is essential for being tax and business efficient. The role of an accountant is to provide financial expertise, guidance, and support to individuals, businesses, organizations, and governments. Here are some of the key responsibilities and tasks of an accountant: Recording financial transactions: The accountant records and tracks financialREAD MORE

Accounting for contractors typically involves a number of specific considerations that differ from those involved in accounting for employees. Here are some key things to keep in mind: Contractor status: It’s important to determine whether a worker is a contractor or an employee, as this will have an impact on how they are taxed andREAD MORE

The report is scathing in its criticism of HMRC implying that HMRC have failed to: Make realistic cost assessments. Fully understand the impact of the changes on businesses and contractors. Understand the wider implications on the impact of the reforms. Below is a summary of the salient points of the PAC report. SUMMARY OF PACREAD MORE

We have written numerous articles on this subject in the past but just recently new rules and changes in tax legislation, particularly Dividend Tax (DT) and National Insurance (NI), have really impacted on the tax efficiency of limited companies. In the past setting up a limited company was an easy way of saving tax andREAD MORE

Inheritance tax is a tax on the ‘estate’ of someone who’s passed away. Many people in the UK will never need to worry about Inheritance tax (IHT) as the total estate is often below the threshold at which IHT is payable. However, for many, the record house prices in the UK particularly in the Southeast,READ MORE

We have written a number of articles on this subject in the past. When setting up a business it is important to consider a number of business factors and you should seek professional advice to work out the optimum business set up. We can advise whether it is more cost effective to set up asREAD MORE

On Wednesday 27 October the Chancellor of the Exchequer delivered his Autumn Budget. Appropriately close to Halloween was it trick or treat? We present a summary of the major points and we ask is it good or bad? We let you decide. National Insurance Contributions Class Tax Year 21/22 Tax Year 22/23 Class 1 PrimaryREAD MORE

HMRC has issued guidance on claiming the fifth and final SEISS grant. We are going to go through the salient points of the HMRC scheme and provide guidance for claiming the grant. Tax Compute can provide further support if required as it is important that the grant is applied for correctly. Unlike the previous fourREAD MORE

We are going to look at the most frequently asked questions by limited company directors about the bounce back loan. It was quite easy to get these loans as there was not a great deal of checking involved and as a result of this there may have been some less than totally honest applications. ThereREAD MORE

Vitally important that small businesses keep up-to-date records and take good care of bookkeeping. So, we are going to offer some tips and advice on how best to do this and avoid future problems. Use the same Accountancy Practice to do all your accountancy, payroll and bookkeeping There are valid reasons for this. Firstly, yourREAD MORE

LIMITED COMPANY VS PRIVATE OWNERSHIP – WHAT IS BEST? Mainly due to changes in mortgage tax relief there has been a huge increase in applications for landlords setting up limited companies. Landlords have quickly seen the advantage of the tax benefits for limited companies. The number of buy-to-let mortgages issued to companies has likewise risen. READ MORE

(Small business guides – written by Xero software) Accountants do more than you think. They can give you strategic advice and come up with clever ways to save money or boost revenue. They’ll also remove or automate administrative tasks that distract you from your core business. Get an accountant and you’ll run your business withREAD MORE

For both new business and those that have a long trading history, an accountant can sometimes be an untapped resource. Whilst dealing with matters of taxation and understanding the processes surrounding this will be squarely under the care of your accountant, there are many areas where their involvement can be invaluable. 1. TAX PLANNING FromREAD MORE

Currently R&D reliefs are available under two schemes and to a certain degree there is some overlap: SMALL AND MEDIUM SIZED ENTERPRISES (SME) R&D RELIEF You can claim SME R&D relief if you are a SME with: less than 500 staff a turnover of under 100 million euros or a balance sheet total under 86READ MORE

The Coronavirus pandemic has undoubtedly been one of the most significant catalysts for economic shake up since the 2008 financial crisis. Most of us remember financial markets around the world taking a remarkable plunge in March 2020 when lockdowns in Europe were announced and the FTSE 100 index in the UK was no exception. AsREAD MORE

To help with tax planning for the 2021/22 tax year we have put together a list of tax-saving tips and reminders about what allowances are available both for business and individuals. With the Chancellor looking to raid businesses to pay for the Covid-19 business support and furlough schemes there has never been a better timeREAD MORE

As the tax year comes to an end it is a convenient time to recap on Salary and Dividend strategy for a limited company director to keep your taxes within a tax bracket that you are happy with and reflects how much you earn and how much you pay in tax. What we will doREAD MORE

UK government body has issued ten coronavirus related scams that we should be aware of and how to spot them. So far, since lockdown began, Action Fraud has logged reports from 2,378 victims across the United Kingdom who have lost a total of more than £7,000,000 to scammers. So be careful. There are a numberREAD MORE

THE CONSTRUCTION INDUSTRY SCHEME (CIS) VAT REVERSE CHARGE SCHEME The CIS VAT domestic reverse charge measure will apply to supplies of construction work from 1 March 2021. The measure was due to commence in October 2019 but has been delayed due to the pandemic. This new scheme has been brought in by HMRC to tackleREAD MORE

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis, either for all or part of the week. This includes if you have to work from home because of coronavirus (COVID-19). You cannot claim tax relief if you choose to work fromREAD MORE

FISHING The UK becomes an independent coastal state and can control access to its waters and fishing grounds. EU boats will continue to have access to fish in UK waters for five and a half years. After that period the UK and EU will regularly negotiate on access to each other’s waters. 25% of theREAD MORE

MAKING TAX DIGITAL – VAT Making Tax Digital (MTD) for VAT was launched in April 2019. All VAT registered businesses above the VAT threshold (£85,000) are now recording and reporting their VAT affairs digitally to HM Revenue & Customs (HMRC) using approved MTD functional compatible software. Businesses with more complex VAT affairs have an extensionREAD MORE

Virtual Christmas parties will qualify for tax exemption. Still plenty of time to hold that party now or in the new-year. HMRC are allowing zoom parties with the same £150/person allowance. You will not have to report anything to HM Revenue and Customs (HMRC) or pay tax and National Insurance for zoom Christmas parties orREAD MORE

It used to be just big businesses that offered apprenticeships but apprenticeships are now a credible option for many small businesses. It is an opportunity for youngsters who do not go to University or those that are unemployed to gain valuable skills for future career advancement. For small businesses it is a credible option toREAD MORE

The furlough scheme has been extended until the end of April 2021 with the government continuing to contribute 80% towards wages – giving businesses and employees across the UK certainty into the New Year, the Chancellor announced on Wednesday. Certainty for millions of jobs and businesses as furlough scheme extended until the end of AprilREAD MORE

OUR SOLUTIONS LIMIT YOUR ACCOUNTANCY, ADMIN AND BOOKKEEPING TO A BARE MINIMUM. Cloud software has transformed accountancy services. There is no longer the need for your Accountant’s office to be near your business or home. If your business is in London take full advantage of lower accountancy fees outside the capital where rents, business ratesREAD MORE

Details For businesses that require fully outsourced bookkeeping services. The price is based on the number of monthly transactions. You will have full access to Xero cloud software and be able to: run your reports at the click of a button, at any time using the App or on your PC. All of the dataREAD MORE

Roger Gunning FCMA CGMA With the November budget looming and the Chancellor looking to raid businesses to pay for the Covid-19 business support and furlough schemes there has never been a better time to tax plan and try and save as much tax as you can. It’s going to get tough for small businesses soREAD MORE

THE FACTS A self-invested personal pension (SIPP) is a form of personal private pension that holds your chosen investments until you retire. It is a type of personal pension and works in a similar way to a standard pension but with the major difference that you choose the funds, investments, stocks that you wish toREAD MORE

As already widely reported the controversial reforms to off-payroll working rules will go ahead in April 2021. Several MPs including David Davis tabled an amendment to the Finance Bill to delay the bill until April 2023 but the motion was defeated back in July this year. There have been other calls from other groups forREAD MORE

The UK government announced today 22nd October new measures to support businesses and employees hit by Tier 2 local lockdown restrictions. Chancellor Rishi Sunak on Thursday told parliament that hospitality businesses in Tier 2 areas would be eligible for new grants. The chancellor also announced more generous support for jobs across the UK and doubledREAD MORE

The scheme is designed to support UK based small and medium-sized businesses, with a turnover of up to £45 million, with a viable business proposition but are struggling with the challenges of the coronavirus situation. Further information can also be found on the British Business Bank and Bank of England websites. You can currently applyREAD MORE

Small businesses that are impacted by the pandemic are eligible to apply for a 100% state-backed loan worth up to £50,000. The scheme helps small and medium-sized businesses to borrow between £2,000 and £50,000. Was launched because of fears small businesses would not be able to access Coronavirus funding quickly enough. The amount of loanREAD MORE

We at Tax Compute do not condone aggressive tax avoidance but having said that we do recognise that individuals and businesses want to pay less tax. So we all need to take advantage of the tax saving measures that HMRC accept and sometimes encourage as part of the tax regime. So below are a fewREAD MORE

Prior to this new tax year 2020/21 UK residents making capital gains on UK residential sales had until the following 31st January to declare and pay any capital gains tax (CGT) due. Prior to this new tax year 2020/21 UK residents making capital gains on UK residential sales had until the following 31st January toREAD MORE

Below we will set out the salient points of Rishi Sunak’s what he calls his “Winter Economy Plan” to protect jobs as the UK and the rest of the world continue to fight the Covid-19 pandemic. The Chancellor unveiled the measures yesterday September 24th. The PM has also warned that the latest Covid-19 restrictions couldREAD MORE

Young people aged 16-24 who are on universal credit will be offered a six-month work placement with wages paid by the government. Young people aged 16-24 who are on universal credit will be offered a six-month work placement with wages paid by the government. Young people taking part in the scheme will receive on-the-job training, skillsREAD MORE

HMRC are inviting self-employed individuals or members of a partnership who have been adversely affected by the pandemic (Coronavirus-19) to claim a second grant HMRC are inviting self-employed individuals or members of a partnership who have been adversely affected by the pandemic (Coronavirus-19) to claim a second grant referred to as the; self-employed income supportREAD MORE

IR35 EMPLOYMENT VERSUS CONTRACTING In this article we will detail some tips on how to stay outside IR35 but it is also worth reviewing the benefits of permanent employment versus contracting. You may read the statement from Contractor websites that “To stay outside IR35 is crucial for the financial health of contractors”. That statement isREAD MORE

It is worth a recap on this subject as the rules can be confusing. Employees and employers alike can get very confused about the rules on what they can claim and what they can’t claim. So let’s review the rules for claiming mileage allowance on business travel for both privately owned and company owned vehicles. READ MORE

Up until the tax year 2016/2017 Landlords have been able to offset 100% of mortgage interest paid against rental income. This is being phased out and replaced by a 20% tax credit allowance. So landlords at the start of the 2020/2021 tax year will no longer qualify for relief on mortgage interest. Instead they willREAD MORE

The scheme announced by the chancellor will provide grants to self-employed individuals or partnerships who are negatively impacted by COVID-19. The grants are worth 80% of profits but up to a cap of £2,500. To be eligible for the scheme you must meet all the criteria below: You must be self-employed or a member ofREAD MORE

VAT Deferral main points HMRC Defers Valued Added Tax (VAT) payments for 3 months. All VAT-registered UK businesses are eligible. The deferral will only apply for the period from 20 March 2020 until 30 June 2020. This will mean the deferral of one quarter’s VAT due on either the 7 April, 7 May or 7READ MORE

If you are thinking of starting a new business in the UK please come and talk to us for totally free advice. We will guide you through making the right choice and making sure your set-up is the most cost effective. This is just a brief summary but gives the basic outline of each legalREAD MORE

IR35 Reforms, Effective new tax year 2020/21, what does it mean?

If you provided services to a client and that client goes into liquidation you can recover the flat rate VAT benefit. You must be registered for the flat rate scheme and you can claim provided the debts are at least 6 months old and the debts have been written off in your accounts. Example YouREAD MORE

We at Tax Compute help small businesses by providing business solutions that save

IR35 and the Public Sector If you are a contractor to the NHS or public sector departments you will most likely be effected by changes to IR35 legislation. The new legislation came into effect in April 2017 and shifted the responsibility for assessing IR35 status to the NHS or other public sectors. What that meansREAD MORE

In this article we will look at the advantages of being incorporated versus those of being a sole trader. In many cases changing from sole trader to limited company can be advantageous but not always. There are several considerations but it usually comes down essentially to the amount of profit you are making. It wouldREAD MORE

Inheritance Tax is paid if a person’s estate (their property, money and

Changes to the VAT flat rate scheme for the 2017/2018 tax year now mean that many small businesses and contractors will no longer benefit from the scheme. A brief explanation of how it works and the impact of the change is detailed below. How It Works You are eligible to join the Flat Rate SchemeREAD MORE

For the 2017/2018 Budget the Chancellor confirmed that the entry threshold

Is it tax efficient to purchase or lease a carthrough the business? This is a complex area and there are several factors to consider. But as a general rule, unless the car has very low CO2 emissions or can be classed as 100% business, it is unlikely that it would be beneficial running the carREAD MORE

Cheques to Clear in Just 24 hours due to new technology At last an end to waiting up to 6 days for your cheque to clear because from October cheques will take just one day to clear. In the modern digital age it was always a nonsense that cheques took up to 6 days toREAD MORE

The National Chairman of the Federation of Small Businesses has hailed