Cheques to Clear in Just 24 hours due to new technology

At last an end to waiting up to 6 days for your cheque to clear because from October cheques will take just one day to clear. In the modern digital age it was always a nonsense that cheques took up to 6 days to clear before the funds could be realised. Now the banks have finally got round to introducing new imaging technology which means a one day turnaround and the opportunity to acquire the funds the next day.

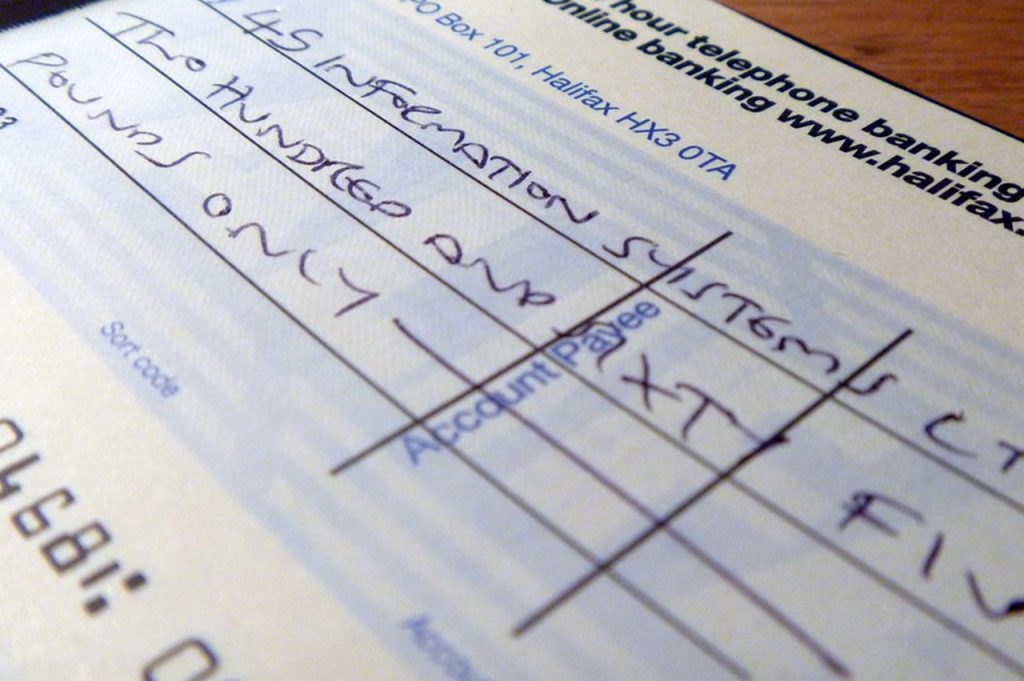

This new banking system will enable images of cheques to be exchanged between banks and building societies instead of moving paper cheques between the relevant bodies up and down the country.

The Cheque and Credit Clearing Company (C&CCC), which manages the cheque clearing system, said the new system will go live with some banks and building societies from October 30. However, not all banks and building societies will be “live” with the new system and it won’t be fully “live” until the second half of 2018. Why the delay for some banks? Not clear but it will finally bring to an end the cash flow benefit that banks and building societies have enjoyed on the billions of cheques that have been processed over the years.

James Radford, chief executive of C&CCC, said: “These changes will put cheques firmly in the 21st century, delivering real and important benefits for the many individuals, charities and businesses that regularly use cheques.”

So how will the new system work?

Firstly a recap on how the old system works. Clearing cheques involves actual paper cheques being posted around the country between the paying and receiving banks. After paying in a cheque, it takes up to two workdays before interest is earnt and a further two days before the beneficiary can withdraw the cash. After that it takes another two days before the beneficiary can be certain that it will be honoured by the bank. So after six days there is still the possibility the cheque could be returned unpaid.

The new system means that instead of this paper chase up and down the country, digital images of cheques will be exchanged between banks and building societies. You will still be able to write a cheque and take it to your bank for processing but instead of the long paper trail, the bank or building society will take an image of the cheque and send it electronically. Additionally, if you participate in on-line banking and you receive a cheque in the post you will be able to upload images and pay the cheques in on-line. You will also be able to use the banking Apps on your smartphone to pay cheques in.

This is good news for everyone but especially businesses who receive many cheques in the post. They will realise those funds in just one workday.