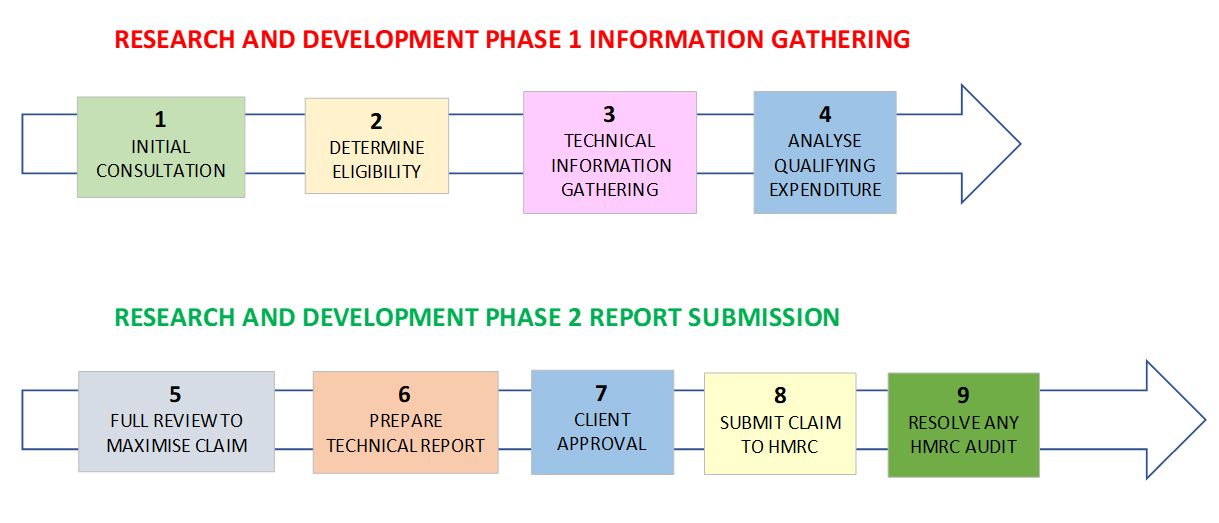

Our process makes claiming R&D tax credits simple. If you believe that you or your company qualify for the R&D tax credit scheme please contact us. We will start by holding a free initial consultation and establishing your Company’s eligibility to claim R&D tax relief. Once we establish eligibility with your approval and agreement we will start the process.

The schematic illustrates the basic process.

- We will keep you fully informed throughout the process

- Achieve maximum recovery by ensuring all qualifying costs are included

- Ensure that we have all the required information needed for HMRC Compliance

- Make sure we understand your business to maximise recovery

- We will advise on the most beneficial treatment of the R&D expenditure for your company

- Full liaison with any HMRC audit

- Making sure you receive the correct R&D tax credit

- We will offer advice on keeping timesheets and better record keeping helping to streamline future claims