As the tax year comes to an end it is a convenient time to recap on Salary and Dividend strategy for a limited company director to keep your taxes within a tax bracket that you are happy with and reflects how much you earn and how much you pay in tax. What we will do here is explain a scenario where you maintain a salary and dividend income and pay zero income tax.

- For the 2020/2021 tax year you can pay yourself a salary of £732 / month without paying any tax or NI. This is perfectly legal and accepted by HMRC. But remember by not paying NI you lose out on future pension benefits. Total salary of £732 x 12 from the company = £8,784

- The dividend allowance is £2,000 per person and this is tax free.

- You have total personal allowance of £12,500 and dividend allowance of £2,000 giving a total allowance of £14,500.

- You can then pay the remainder of your personal allowance as dividends without any tax = £12,500 less the salary of £8,784 = £3,716.

- So you have paid yourself a salary of £8,784 and £5,716 dividends (£3,716 + £2,000) which makes up your total personal allowance of £14,500

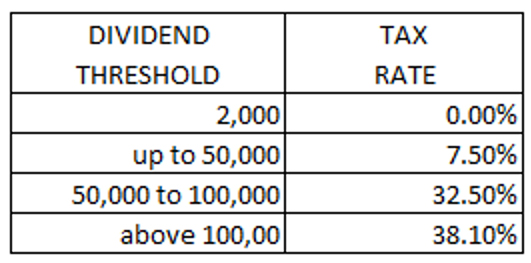

- Once you have used up all your personal allowances the following tax rates apply:

The rates of tax are:

- If you wished to stay within the lower tax band you could take additional dividends of £35,500 at 7.5% would generate a tax liability of £2,662.50

- In this example your total dividends are £5,716 + £35,000 =£41,216

- Dividend income over £41,216 will attract tax at 32.5%.

- If your income exceeds £100,000 you start to restrict your personal allowances

- Always check with us to manage and maximise your tax strategy and provide a tax plan that meets your requirements and circumstances.

PLEASE NOTE:

- Dividends are paid out of post-tax profits.

- Failure to process your payroll and submit the correct RTI (Real Time Information) returns could result in fine or penalties.

- Salary payments are an allowable business expense and will reduce the profits subject to corporation tax.

Roger GUNNING FCMA CGMA